Last year in September, we wrote an article on the challenge of meeting aggressive environmental goals while ignoring the demand side of the energy equation. Energy transition and climate change policy and investment initiatives had thus far been focused on reducing our reliance on fossil fuels in energy supply to control carbon dioxide (CO2) emissions. But our relentlessly growing consumption of energy across the globe had made meeting aggressive emission reduction targets near impossible. The COVID-induced reduction in energy demand has more than demonstrated the significance of demand in realizing aggressive emission reduction targets. In its early days, COVID19 successfully delivered an energy transitions experiment, proving that these goals are only attainable through transitions in not only energy supply but also energy demand.

A quick analysis of the EIA July 2020 Monthly Energy Review reveals some key insights about the fast arriving transformed future that are critical for energy industry leaders and policymakers to consider when making strategic choices. In April 2020, the U.S. went through a somewhat effective energy transitions experiment. The outcomes have clearly been far from pleasant for the industry. But they offer some important insights about what it takes to for energy transitions and related climate change goals to be met and how they will affect fundamentals for players along the supply chain of the energy industry.

Sustainability and Climate Action Plans that Don’t Address Demand Growth are Just Plans

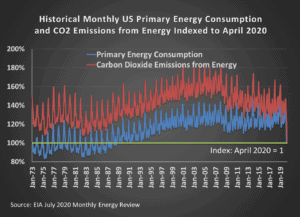

In April 2020, the U.S. energy industry saw the most meaningful reduction in its monthly carbon dioxide emissions in over five decades. CO2 emissions from energy consumption were about 8% lower than in June 1982- the lowest monthly emission level since January 1973. Many have rushed to thank recent innovations and investments in renewable energy technologies for the acceleration of energy transitions. But renewable energy production in April was actually lower than its monthly average over the last three years. Total primary energy consumption, on the other hand, dropped to levels not seen since September 1989 suggesting that demand contraction was the major driver behind the reduction in emissions.

In April 2020, the U.S. energy industry saw the most meaningful reduction in its monthly carbon dioxide emissions in over five decades. CO2 emissions from energy consumption were about 8% lower than in June 1982- the lowest monthly emission level since January 1973. Many have rushed to thank recent innovations and investments in renewable energy technologies for the acceleration of energy transitions. But renewable energy production in April was actually lower than its monthly average over the last three years. Total primary energy consumption, on the other hand, dropped to levels not seen since September 1989 suggesting that demand contraction was the major driver behind the reduction in emissions.

The Sectoral Transition in Energy Demand is Pacing Up

COVID19 lockdowns, stay-home orders, and social distancing guidelines this year restricted human mobility to levels probably not seen in several decades. Fortunately, the digital transformation had delivered technologies that are making business continuity and social connections still largely possible. We now rely on technology much more expansively to engage socially, run businesses, and buy and sell everything and anything from home. This translated into much larger consumption declines in the transport, industrial, and commercial sectors compared with the electricity and residential sectors.

In April 2020, the residential and electricity sectors represented a total of 46% of primary energy consumption versus 41% last year. As productivity and performance concerns around remote working and virtual meetings get addressed, it is unlikely that we will ever return to our previous norms of travel by air, sea, or land. The COVID19 experience has inspired leaders to think differently about resource allocation. Many major tech companies have extended their remote working policy until next summer and some announced that employees will now have the choice to work remotely indefinitely. This means that the energy demand transition from the commercial and industrial sectors to the residential sector, and from transport to electricity could continue even post COVID19. This trend could only get multiplied as a result of the transition of consumption from oil to electricity with the proliferation of electric vehicles. As a result, oil consumption may never return to its pre-COVID19 levels which suggests that “peak oil” may already be behind us.

The Role of Natural Gas as a Bridging Fuel Cannot be Ignored

It will take some time before we have fully figured out ways to manage our energy appetite, de-link economic growth and energy demand growth, or further expedite investments and innovation in renewable and storage technologies. The recent blackouts of a struggling electric system in California demonstrate why natural gas generation will still be important at least until sufficient storage capacity is in place to mitigate the intermittency of zero carbon generation and maintain reliable operations.

In April 2020, when U.S. carbon emissions from energy consumption hit historic lows, natural gas consumption actually rose by 2% compared with April 2019 while consumption of all other sources (including renewable energy) declined. This was driven by the sectoral energy demand shifts described above: transport to electricity, and commercial to residential. Also, new efficient gas-fired electric generation continues to displace coal-fired generation. As a result, our energy consumption mix saw a larger contribution of natural gas compared to 2019 at the expense of petroleum and coal. This trend may not be indicative of the eventual destination of energy transitions but of the path to get there.

And Finally Understanding and Predicting Demand under Different Scenarios is Imperative for Success

It is unfair to argue that anyone could have predicted something of the nature and scale of the COVID19 crisis and its implications on the energy demand transition. But forming alternative views on the demand dynamics expedited by COVID19 was not out of reach, because they had been evolving for some time. Digital technologies had been enabling businesses, employees, and customers in new ways for some time. Sustainability and climate change goals had been getting more aggressive, and investment in related technologies had been pacing up for a couple of decades. And the abundance of cheap natural gas resources in the U.S. has positioned it for its temporary bridging role some time ago.

As has been evidenced thus far this year, and especially in April, the progress made on energy transitions and the digital transformation increases the energy industry’s vulnerability to demand uncertainties- especially for oil and gas players. There are multiple sub-regional and global dimensions that we haven’t discussed here but will remain highly relevant and volatile. The ability to formulate and embed various energy demand scenarios into top level/big picture decision making will differentiate the winners not only in the long-term, but also in the short and medium terms as experienced this year already.

The April 2020 experiment, while painful from an economic and public health point of view, was a nice joined up energy supply and demand case study on what it takes to achieve aggressive carbon emission reduction goals. And regardless of our position on the science of climate change, as industry leaders we would all benefit from understanding demand transition dynamics and their implications on our business.